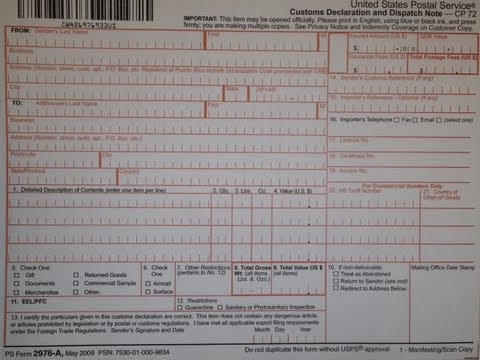

Youyouhello this is Steve from chaotic thinking calm here today to explain how to fill out a postal form 2976 — a or customs declaration in regards to sending to an overseas military member at an APO or FPO address Theresa;#39’s two variations of the form the larger one is the 2976 a and the smaller one is just the 2976 the smaller one is used for smaller items flat items or anything under four pounds so if the objectyou'resending is over four pounds in weight then you need to use the larger one that you see here when you first pick the form up in the post office it has this cover she wants to hear what the instructions on how to fill out each section the smaller ones cover sheet looks like this the smaller one has sticky adhesive here on the back and this would just be stuck to the packageI'’m not gonna cover how to fill out this one because once you understand the other one stamp;#39’s the same thing applies to this one the larger form the — a goes into a 2976 — II which is just a clear envelope and the postal worker when they are processing your package thalami;#39;ll actually put it in the envelope and stick it and I hear it — your package for yours previously mentioned the instructions for filling out each block is on the cover sheet but in order to assist infilling out the entire form lamp;#39’s Godhead and take a look at an example address once you understand the address then it all kind of makes sense this should be similar to the address that you have with the first and last name and you probably have two lines for theunitNader here, and then you have...

What you should know about Cbp form 7551

- CBP form 7551 is used for duty drawback claims.

- Instructions on how to fill out CBP form 7551 are available on the form itself.

- A fillable PDF version of CBP form 7551 is available online.

Award-winning PDF software

How to prepare Cbp form 7551

1

Obtain the CBP Form 7551 on the web

Make use of your desktop or mobile device to start the sample online in a PDF editor. Click Get Form to look at the present edition of the document template.

2

Fill in the form

Complete the template step by step, writing correct info. When there is a signature field, add your signature by drawing or typing it.

3

E-file the file

You can pass printing and send your papers on the internet by means of e mail. Consult with the specific regulators if the template is approved electronically.

About Cbp Form 7551

CBP Form 7551 is a document used by the United States Customs and Border Protection (CBP) agency. It is called the "Drawback Entry" form and is used by importers to claim duty drawback, which is a refund of the customs duties paid on imported merchandise. The CBP Form 7551 is required by any importer who wishes to claim a duty drawback on imported merchandise. This includes individuals, partnerships, corporations, and any other organization that imports goods into the United States and wishes to receive a refund of the corresponding customs duties paid. It is important to note that specific rules and regulations apply to each type of claim, so it is essential to take expert advice before submitting a claim for a duty drawback.

People also ask about Cbp form 7551

What is the purpose of CBP form 7551?

CBP form 7551 is used for duty drawback claims.

How can I fill out CBP form 7551?

Instructions on how to fill out CBP form 7551 can be found on the form itself.

Where can I find a fillable PDF version of CBP form 7551?

A fillable PDF version of CBP form 7551 can be found online.

What people say about us

Submit paperwork in a timely manner with a reliable online solution

Video instructions and help with filling out and completing Cbp form 7551